C/2024/7267 Prior notification of a concentration (Case M.11717 – SUMITOMO / EEW HOLDING / EEW OFFSHORE WIND EU HOLDING)

COMP-MERGER-REGISTRY@ec.europa.eu

Sumitomo Corporation (sumitomo) . sumitomocorp ticker = 8053:TYO

The COCOO: OBSERVATIONS

-sumitomo receives state aid , and therefore a selective advantage, from different nations, specially from Japan. This has contributed to today’s signification competition distortion in the global wind power installations industry. sumitomo and other Chinese corporations in this industry, today fully dominate globally and in many national markets.

-eew holding also recieves state aid from germany. if this deal is allowed, the combined selective advantages will add up.

-should the deal be cleared, the european commission would be responsible for allowing a potential risk that sumimoto would be using its dominant position to also abuse such dominance in the eu internal market. As it has happened in other nations, sumitomo produces, relative to european standards, cheap but low quality products, that could easily end up in numerous dumping proceedings in the eu courts.

-sumimoto has been excluded from loans/investment by Norges bank, and is labelled as ‘unethical’ as it is included in the ‘ethical exclusions list’ .

–Sumitomo Electrical Industries (part of the proposed undertaking) features on the official Iranian vendor website.

-sumimoto is gradually acquiring and investing in rival firms and designing such deals to avoid hitting any thresholds. This has led to a gradual process of ‘stealth consolidation’ in this industry which is in breach of competition laws and policies. More worryingly, growing consolidation in industries like the one that concerns us, where public safety is paramount, has the proven potential to result in a relaxation of quality and safety measures that could result in public harm.

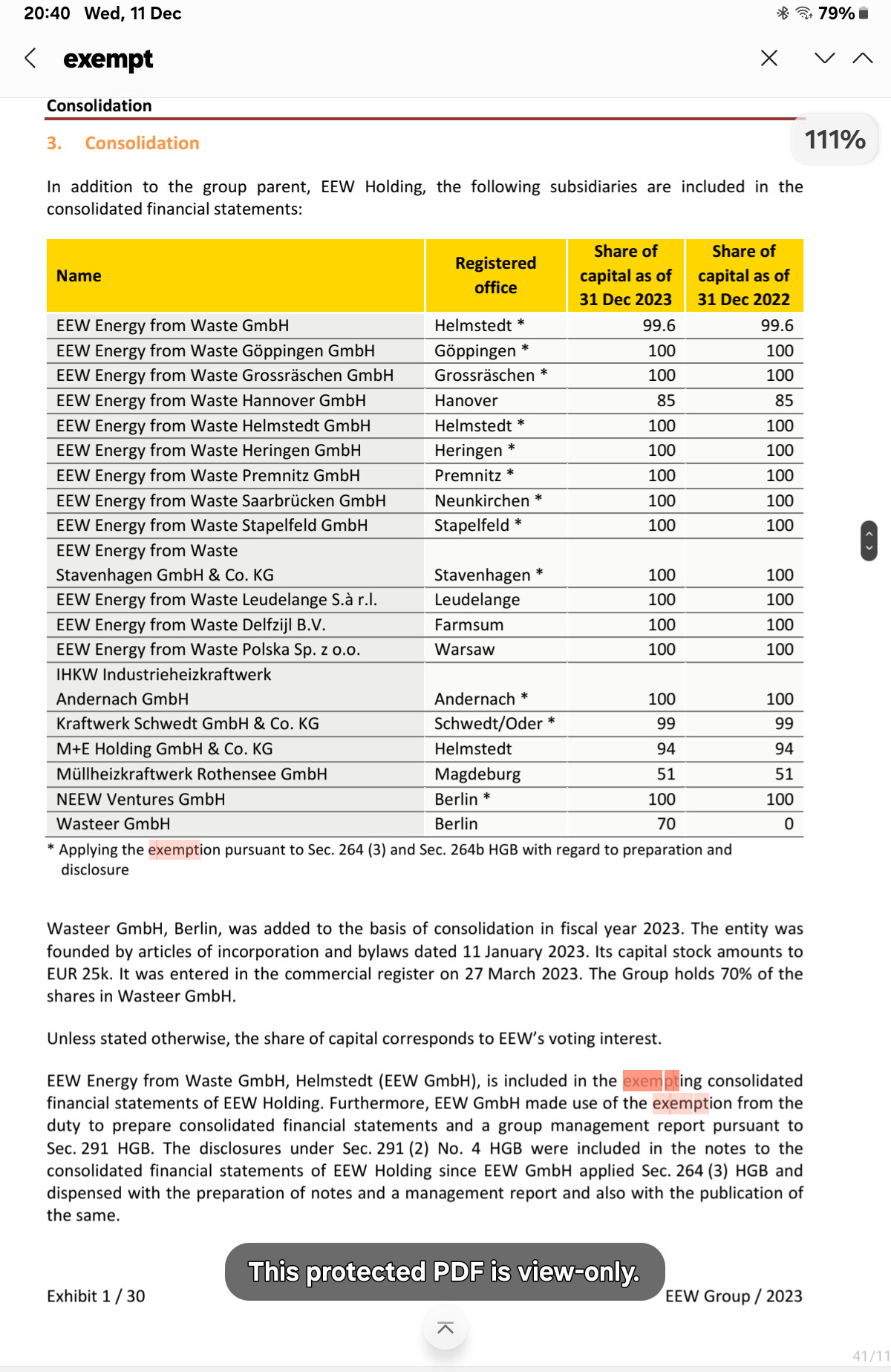

– : EEW Energy from Waste GmbH: parent relation: NON-CONFORMITY: FAILS TO HAVE APPROPRIATE (dir or ultimate) RELATION OR REPORTING EXCEPTION WITH VALID REASON. Therefore, sumimoto has failed its duty to disclose its ‘ultimate parent’ because the exemption that sumimoto requested is invalid. Consequently, the commission is under a duty to review this deal, because, without such review, it is impossible to know the full scope of the undertaking agreement networks that concern us in the proposed deal. The commission has a duty, before it may decide not to review the proposed deal, to learn not only of the organisational undertakings, but also of the financial ones.

-The 2030 Agenda’s urgency, is forcing the european wind power installation industry, to rush economies of scales to try to avert a gradual increase of demand over supply in the internal market, where chinese companies would the only companies in the world in a position to balance demand and supply in the internal market. Many eu offshore wind manufacturers already rely on china for their turbines, monopiles being used in european projects. This is despite the number of unfair competition and cartel litigation lost in the past by sumitomo.

– sumimoto is composed of many companies some of which are potential direct rivals of european companies in the industry. clearing the proposed deal would bring to the internal market and additional source of industry concentration, as it would aggregate to the existing level of ‘stealth consolidation’. Sumimoto is rather a ‘trojan horse’ that should not be allowed to complete the proposed deal.

-For national security reasons, under the wider public interest, the commission is under a duty not to allow china, and in particular sumimoto, any opportunity to capture more market share in this industry.

– the commission is under a duty to promote the birth and health of industries in member states, to comply with the Treaty’s overarching objective, the internal market.

-Urgency of challenge has been brought home by string of recent breakthrough deals for Chinese OEMs in Europe: EU countries must find common answers to the challenge of cheap Chinese turbines, said Denmark’s climate and energy minister ahead of a meeting between North Sea nations on their plans for offshore wind. “For me as a Danish minister, and with the role the wind turbine industry has in our country, I’m of course concerned about whether European manufacturers are outperformed by state aid in a way which is unfair,” Danish minister Lars Aagaard told Reuters.

-Sany’s Europe director claimed Western wind giants ‘have left door open’ to Chinese by retreat from various markets. European turbine makers relying on China’s supply chain could soon be in for an unpleasant surprise, Sany’s Europe chief has warned, while hitting back at comments from WindEurope’s CEO and also the company the Chinese OEM’s executive described as the “most expensive turbine supplier on the face of the universe.” Europe’s wind sector, led by industry body WindEurope, has been sharply critical of Chinese OEMs in recent years, amid concerns they could outcompete local players on the continent with turbines allegedly subsidised unfairly by the Chinese state.

For all the above reasons it is our opinion that it would be impossible for the commission to make a reasonable decision to review or not to review. The commission has therefore a duty to review the proposed deal, as the commission is not, presently, in a position to make a balancing act between competition law/policy, and other possible interests, like environmental sustainability as imposed by the 2030 Agenda.

Addendum: evidence in the form of links and excerpts

https://www.lobbyfacts.eu/datacard/eew-energy-from-waste-gmbh?rid=060318238252-62&sid=193699

-https://www.globaltradealert.org/intervention/123002/financial-grant/japan-government-announces-state-aid-to-sumitomo-electric-industries-for-producing-silicon-carbide-wafers:

-ANNOUNCEMENT 19 Nov 2024: In November 2024, the Japan Bank for International Cooperation (JBIC) signed a USD 180 million agreement with Sumitomo Metal Mining for the development of the Quebrada Blanca copper mine in Chile

-The two buyer’s credit agreements between JBIC and Danish Ultrabulk Shipping A/S was signed on 1 October 2014 and has a total maximum value of USD 18.6 million. Additionally, the loan is co-financed by a private financial institution amounting to an approximate value of USD 37.3 million. The governmental agency Nippon Export and Investment Insurance will provide an insurance for the co-financed portion. The loan finances the purchase of two bulk carriers, built by Japanese Oshima Shipbuilding Co., Ltd., from Japanese Sumitomo Corporation. In this context, JBIC stated: “These loans are intended to support the export of ships built by Japanese shipbuilders which perform a significant role in the regional economy and associated industries, including mid-tier enterprises and small and medium-sized enterprises (SMEs). Thus, these loans will contribute to maintaining and strengthening the international competitiveness of the Japanese shipbuilding industry.” Buyer’s credit agreements: JBIC provides direct loans named buyer’s credit to overseas importers. Loans are obtained if it finances the purchase of Japanese machinery, equipment or technology in specific eligible sectors. The Bank hereto stated that these loans are intended to “positively contribute to Japanese companies”. Further information can be found on the Bank’s website under export loans.e to Japanese companies”. Further information can be found on the Bank’s website under export loans. The GTA includes state guarantees and other financial incentives that are likely to affect the restructuring and performance of firms facing international competition, whether from imports, in export markets and from foreign subsidiaries

–apan: JBIC announces a USD 180 million loan agreement with …

https://www.sumitomocorp.com/en/jp/about/company/scgroup/region/region01 = MAYOR SUBSIDIARIES AND ASSOCIATED COMPANIES.

: cartels by sumitomo and/or their subsidiaries or undertakings :

- SUMITOMO/ITOCHU/TOYO/AK&N (Merger) – COMP/M4769 [2007] ECComm 209 (20 August 2007)

(From Commission of the European Communities; - Sumitomo Metal Industries v Commission (Competition) [2006] EUECJ C-405/04 (12 September 2006)

(From Court of Justice of the European Communities (including Court of First Instance Decisions); 127 KB) - Sumitomo Metal Industries v Commission (Competition) [2006] EUECJ C-403/04 (12 September 2006)

(From Court of Justice of the European Communities (including Court of First Instance Decisions); 127 KB) - Sumitomo Electric Industries and J-Power Systems v Commission (Competition – European market for power cables – Judgment) [2018] EUECJ T-450/14 (12 July 2018)

(From Court of Justice of the European Communities (including Court of First Instance Decisions); 94 KB)

marketresearch.com: sumitomo : Sumitomo Corp other Key Recent Developments :

Oct 15,2024: Sumitomo Corporation Group Establishes Joint Venture to Develop Renewable Energy Projects in Virginia, United States

Sep 24,2024: Asyad Group, OQ Alternative Energy, and Sumitomo Corporation ME Chart Ambitious Course to Establish Oman as a Global Low-Carbon Fuel Bunkering Hub

Sep 13,2024: Sumitomo Corporation Establishes Renewable Energy Development and Supply Company in India

Sep 13,2024: Sumitomo Corporation Establishes Renewable Energy Development and Supply Company in India

Company To Pay $150 Million And To Cease And Desist From Further Violations: The Commodity Futures Trading Commission (CFTC) today announced that it was issuing an order, in connection with settling the matter by consent, finding that Sumitomo Corporation of Japan (Sumitomo) manipulated the copper market in 1995 and 1996.

-The court did allow a claim of unfair competition under California law to proceed, and it allowed similar claims under Florida and Hawaii law, to the extent the claims are not premised upon fraudulent conduct.

-https://curia.europa.eu/juris/recherche.jsf?language=en# >>

CURIA: EEW ENERGY FROM : In Case C‑580/21: EEW Energy from Waste Großräschen GmbH v MNG Mitteldeutsche Netzgesellschaft Strom GmbH. eew engery holdings was found to restrict entry to new potential competitors, on the basis that: priority access to the electricity grid enjoyed by electricity generating installations using renewable energy sources must be granted not only to installations producing electricity exclusively from renewable energy sources, but also to those producing from both renewable and conventional energy sources. Article 16(2)(c) of Directive 2009/28 : must be interpreted as meaning that an installation which produces electricity from both renewable and conventional energy sources enjoys priority access to the grid solely in respect of the proportion of electricity produced from renewable energy sources. It is for the Member States to establish the detailed rules for applying that priority access, by setting transparent and non-discriminatory criteria which, whilst taking into account requirements relating to the maintenance of reliability and safety

Sumitomo Corp is an integrated trading company. It operates through six business segments: Metal Products, which includes various metal products, such as steel products and non-ferrous metal products; Transportation & Construction Systems, which is engaged in transactions involving ships, aircrafts, transportation systems, motor vehicles, construction equipment, and related components and parts; Infrastructure, which is engaged in a range of overseas infrastructure development projects, such as power generation, renewable energy business and others; Media and Digital, which is engaged in cable television (TV) operations and movie business, among others; Life and Real Estate, which includes food supermarkets, healthcare-related businesses, facility and fund management, real estate business and others, and Mineral Resources and Chemical, which is engaged in the development and trading of mineral and energy resources and commodity derivative transactions.

Peer analysis

| Company | Revenue (TTM) | Net income (TTM) | Market cap | Employees |

|---|---|---|---|---|

| BayCurrent Inc | 104.28bn | 27.48bn | 835.65bn | 4.32k |

| Secom Co Ltd | 1.17tn | 103.15bn | 2.48tn | 64.74k |

| Toyota Tsusho Corp | 10.12tn | 335.23bn | 2.79tn | 69.52k |

| Marubeni Corp | 7.39tn | 458.23bn | 3.79tn | 50.20k |

| Sumitomo Corp | 7.08tn | 355.21bn | 4.06tn | 79.69k |

| Mitsui & Co Ltd | 14.28tn | 1.02tn | 9.63tn | 53.60k |

| Mitsubishi Corp | 19.36tn | 1.12tn | 10.38tn | 80.04k |

| Itochu Corp | 14.55tn | 827.31bn | 12.20tn | 113.73k |

| Recruit Holdings Co Ltd | 3.51tn | 363.08bn | 18.68tn | 51.37k |

| Holder | Shares | % Held |

|---|---|---|

| Berkshire Hathaway, Inc. (Investment Management)AS OF 12 JUN 2023 | 101.21m | 8.36% |

| Nomura Asset Management Co., Ltd.AS OF 07 NOV 2024 | 53.77m | 4.44% |

| Sumitomo Mitsui Trust Asset Management Co., Ltd.AS OF 15 AUG 2023 | 40.73m | 3.36% |

| The Vanguard Group, Inc.AS OF 31 OCT 2024 | 34.89m | 2.88% |

| Nikko Asset Management Co., Ltd.AS OF 15 AUG 2023 | 24.99m | 2.06% |

| Daiwa Asset Management Co. Ltd.AS OF 31 OCT 2024 | 23.40m | 1.93% |

| BlackRock Fund AdvisorsAS OF 07 NOV 2024 | 21.00m | 1.73% |

| Norges Bank Investment ManagementAS OF 30 JUN 2024 | 18.50m | 1.53% |

| Geode Capital Management LLCAS OF 05 DEC 2024 | 13.48m | 1.11% |

| Mitsubishi UFJ Asset Management Co., Ltd.AS OF 07 NOV 2024 | 12.61m | 1.04% |

EUROSTAT >> WINDPOWER:

https://ec.europa.eu/eurostat/web/main/search/-/search/estatsearchportlet_WAR_estatsearchportlet_INSTANCE_bHVzuvn1SZ8J?p_auth=9qqSgHKn&_estatsearchportlet_WAR_estatsearchportlet_INSTANCE_bHVzuvn1SZ8J_text=Wind+powered+electricity+generating+capacity+increased+by+over+150%25+in+the+EU25+since+2000

ec: Candidate case for simplified procedure (Text with EEA relevance) (C/2024/7267)3.12.20241. On 26 November 2024, the Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 (1).This notification concerns the following undertakings:— Sumitomo Corporation (‘Sumitomo’, Japan),— DiScho Vermögensverwaltung GmbH & Co. KG, previously EEW Holding GmbH & Co. KG (‘EEW Holding’, Germany). EEW Holding currently wholly-owns EEW Offshore Wind EU Holding, which holds the shares of (i) EEW Special Pipe Constructions GmbH (‘SPC’), (ii) AWS Schäfer Technologie GmbH (‘AWS’), (iii) EEW Management Services GmbH (‘MS’), and (iv) EEW Offshore Wind Holding Komplementär GmbH (‘EEW Komplementär’). EEW Offshore Wind EU Holding together with SPC, AWS, MS, and EEW Komplementär are referred to as the ‘Target’.Sumitomo and EEW Holding will acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of the whole of the Target. The concentration is accomplished by way of purchase of shares.2. The business activities of the undertakings concerned are the following:— Sumitomo is a global trading and investment company. It is active in trading and investment in a range of business activities in Japan and around the world, including steel, automotive, transportation and construction of systems, diverse urban development, media and digital, lifestyle, mineral resources, chemical solutions and energy transformation,— EEW Holding is a German asset managing partnership. It is active, through the Target, in the production of both monopiles used in wind farms and machinery to produce and/or process pipes (including monopiles).3. On preliminary examination, the Commission finds that the notified transaction could fall within the scope of the Merger Regulation. However, the final decision on this point is reserved.Pursuant to the Commission Notice on a simplified treatment for certain concentrations under Council Regulation (EC) No 139/2004 on the control of concentrations between undertakings (2) it should be noted that this case is a candidate for treatment under the procedure set out in the Notice.4. The Commission invites interested third parties to submit their possible observations on the proposed operation to the Commission.Observations must reach the Commission not later than 10 days following the date of this publication. The following reference should always be specified:M.11717 – SUMITOMO / EEW HOLDING / EEW OFFSHORE WIND EU HOLDING

>> YAHOO.FIN: SUMITOMO/EEW >> : In This Article: SSUMY :

Japan’s Sumitomo Corporation has acquired an equity stake in EEW Offshore Wind Holding to enhance its monopile manufacturing capabilities. This strategic partnership brings together Sumitomo’s extensive expertise in the international steel market with EEW’s specialised focus on offshore wind energy infrastructure. Sumitomo Corporation steel products SBU [secondary building units] general manager Takuro Horikoshi stated: “We are excited to partner with EEW, enhancing our role in the offshore wind market. “This investment aligns with our commitment to contributing to green transformation and global shift to renewable energy.” EEW Offshore Wind Holding, a German family-run business, has been restructured into three new holding companies to better organise its group activities according to business segments. The monopile production at Rostock (EEW SPC) and the associated mechanical engineering activities at AWS Schäfer in Siegen, Germany, are now under the umbrella of EEW Offshore Wind Holding. The newly established EEW Management Services will absorb the services previously offered by EEW Holding, aligning with the new divisional structure. The additional two holding companies, EEW Pipe Solutions Holding and EEW AOS Holding, will manage the group’s other business areas and locations. Despite the changes, the existing management team of the group will continue to lead the operations. EEW Holding is set to transition into a purely asset-managing entity, renaming itself to DiScho Vermögensverwaltung, and will cease to provide services or act as a parent company. The partnership with Sumitomo, which employs 80,000 people across 65 countries, signifies a confident step towards addressing future challenges in the offshore wind sector. EEW assured its customers that the quality of large-scale monopile projects will remain consistent and reliable. Sumitomo’s investment in EEW Group is a result of a long-standing business relationship, and the completion of this transaction is pending approval from relevant EU authorities. EEW Group managing partner Christoph Schorge stated: “In order to continue to secure our position as global market leader, to continue to enable healthy growth and to be able to draw on sufficient resources to successfully handle large-scale projects, we, the owner families of Schorge and Dietze, have decided to bring a trusted strategic partner on board for this division.”

- In our view, Germany-based EEW Energy from Waste GmbH’s (EEW)’s credit metrics will remain subpar for a ‘BBB’ rating, as we now anticipate adjusted debt to EBITDA at 3.0x-3.8x over the next three years, compared with around 2.3x previously.

- The company has materially increased its investment plan into growth- and decarbonization projects and is expected to spend about €300 million in 2024 and €200 million in 2025 in capex, which is significantly above last year’s expectation.

- In addition, we now forecast an EBITDA margin of around 31%-33% in 2024, which is slightly below the historical average of around 34%.

- Since earnings will not be sufficiently high to fund EEW’s investment plan, we now expect a more rapid debt increase than previously assumed. We now expect EEW’s S&P Global Ratings-adjusted debt to increase to about €900 million by year-end 2025, compared with €686 million in 2023 as a higher share of capital expenditure (capex) will need to be debt funded.

- We therefore lowered to ‘BBB-‘ from ‘BBB’ our long-term issuer credit rating on EEW.

- The stable outlook reflects our view of the company’s strong market position within the energy from waste (EfW) market as well as its continued benefit from the medium-term contract structure with its customers, and that we expect debt to EBITDA in the 3x-4x range.

FRANKFURT (S&P Global Ratings) July 11, 2024–S&P Global Ratings today took the rating actions listed above. Weak financial measures led us to downgrade EEW by one notch to ‘BBB-‘ and revise downward its financial risk profile assessment to significant from intermediate.

We expect EEW’s earnings to be insufficient to funds its expanding investment plan into growth projects, further adding pressure on its financial metrics.

We expect the company’s waste reception volumes to remain stable over the forecast horizon, as they are covered by long- and medium-term contracts with municipalities as well as commercial and industrial (C&I) clients

We recognize the support provided by BEHL but continue to assess EEW as non-strategic to its parent

= Global Energy Ownership Tracker

Information on the chain of ownership for various energy projects. The data maps each level of the chain from the direct owner up to their highest-level ultimate parents.

The Global Energy Ownership Tracker provides information on the chain of ownership for various energy projects. The data maps each level of the chain from the direct owner (as in, the lowest-level identified owner in the chain of ownership) up to their highest-level ultimate parents (e.g., corporations, investment firms, and governments).

Ownership links are reported with the percentage of ownership, including owners that have controlling interest as well as those with minority, non-controlling interests (if over a threshold of 5% ownership).

NORTHDATA(co.search) >> eew holding >> >> (gives list of connected cos and subsidiaries) >> LEI RELATIONSHIPS… LEI.search >>

EEW HOlding = EEW Energy from Waste GmbH

egistered At Commercial Register (Local Court Braunschweig), Handelsregister (Amtsgericht Braunschweig) Braunschweig, Germany . RA000221

-Parents:

-Ultimate Parent: NON_PUBLIC. Ultimate Parent. The very top company listed in a company hierarchy and the ultimate controlling company. within a corporate structure. Parent may not be the “ultimate parent, if it has to report to another legal entity….771-130 Ultimate Parent Entity: The Ultimate Parent Entity (UPE) is an Entity which:

•owns, directly or indirectly a Controlling Interest in any other Entity; and

•is an Entity in which no other Entity has a Controlling Interest (directly or indirectly)

See ¶771-113 for the definition of Controlling Interest.

Where the MNE Group is a single body with PE’s, the UPE is the body of which the PE’s are considered to be a part…An Entity can be a UPE if it is the parent in a ‘deemed consolidation’ see ¶771-113. The OECD Commentary provides guidance on the definition of UPE as it applies to a sovereign wealth fund, and a sovereign wealth fund which qualifies as a Governmental Entity (¶771–140) will not be a UPE. OECD Model Rules:Article 1.4. UK legislation: F(No.2)A 2023, s. 126(2)(a)

=================================================

Related party transactions (RPTs)

FRS 102:33.9 sets out the minimum information to be disclosed about related party transactions which are not able to take the disclosure exemption (i.e. where there is a not 100% parent/subsidiary relationship, or two subsidiaries which aren’t both 100% owned within the same group).

Disclosures shall include:

- •the amount of the transactions;

- •the amount of outstanding balances and:

- –their terms and conditions, including whether they are secured, and the nature of the consideration to be provided in settlement;

- –details of any guarantees given or received;

- •provisions for uncollectible receivables related to the amount of outstanding balances; and

- •the expense recognised during the period in respect of bad or doubtful debts due from related parties.

This is quite a level of detail, meaning that any users of the financial statements should be able to form a full picture of the transactions’ true nature and whether it appears that the related party relationship seems to have made its terms different from normal. There is no specific requirement to name the related parties involved. FRS 102 requires the nature of the related party relationship to be disclosed instead. In addition, the standard requires that the disclosures are provided separately for the following categories of related party:

- •investors in the company (those which have control, joint control or significant influence);

- •investees of the company (subsidiaries, joint ventures or associates);

- •key management personnel;

- •entities which provide key management personnel services to the company; and

- •other related parties (this would include, among others, fellow subsidiaries in a group, close family of key management personnel, and pension schemes).

A company may also aggregate items of a similar nature within these groupings; however, separate disclosure is required where this is necessary for a full understanding of the effects of related party transactions on the financial statements. For example, a company that guarantees the debts of both one of its fellow subsidiaries and a close family member of one of the directors would, in theory, be able to aggregate the disclosures of these items in the category ‘other related parties’. This aggregation, though, would obscure the uncommon nature of the guarantee for the family member and therefore one would expect separate presentation. Depending on the volume and diversity of a company’s related parties and its transactions with them, the most efficient and readable way of providing the required disclosures will vary. For entities with a small number of simple arrangements, a few lines of narrative with figures may be sufficient; if the situation is more complex, though, a matrix presentation is easier to read at a glance, and can be augmented if necessary with additional narrative. Companies should be careful not to state that related party transactions are made on terms equivalent to an arm’s length basis as the standard only allows such statements if those terms can be substantiated.

Relationships that change during the period

The standard is silent on the situation where relationships change, such that another entity is a related party of the reporting entity for only part of the year. On the face of it, several different policy decisions would be compatible with this lack of guidance:

- (1)Disclose transactions and year end balances only with entities which are related parties as at the reporting date.

- (2)Disclose transactions and year end balances with all entities which were related parties at any point during the year.

- (3)Disclose transactions with all entities which were related parties as at the date of the transaction, and outstanding balances relating to those transactions.

- (4)As per (3) above, but also disclose outstanding balances with parties which were not related parties at the time of the transaction but have subsequently become related parties.

The argument supporting approach 1 is that the definitions in FRS 102:33.2 are all in the present tense, which might be read as implying that related party status is assessed at a single point in time, being the reporting date. The wording in FRS 102:33.9 is compatible with this, beginning as it does with ‘If an entity has related party transactions’ – one might suggest that if the standard setters meant any of approaches 2–4 to be used, then they would have used language such as ‘if an entity had transactions with related parties during the year’ or similar…..However, looking back to the goal of this section, it pushes towards a broader reading. The underlying reason for disclosing related party transactions is to allow users to make their own assessments of whether and how this type of relationship may have affected the pricing, terms or any other aspect of the transaction. In other words, the relationship that was in place at the point when the transaction happened is the critical one, effectively ruling out approaches 1 and 2 (approach 2, in failing to discriminate between transactions when the counterparty was related and those when it was not, risks obscuring the information that is most relevant). Any balances still outstanding at the year end which relate to these transactions are likely still to be of interest, even if the counterparty has subsequently ceased to be related (in particular, it may cast an interesting light on this judgement, if there is theoretically no longer a close link between the companies but balances have nonetheless been able to remain outstanding for longer than would be normal or expected). Finally, if a transaction’s counterparty was not related as at the time of the transaction but has subsequently become so, the outstanding balance becomes interesting, since the new relationship may have altered the repayment terms.

Thus, approach 4 seems to be the one most in line with the aim of FRS 102:33, although there are no clear statements in the standard explicitly prohibiting any of the other approaches. In any event, the accounting policy note should make it clear how such a situation is treated. Also, if there are significant transactions or balances with parties whose status changed during the year, additional narrative disclosure would be helpful. An example would be a statement such as ‘Included within sales to group companies in the table above is £150,000 of sales to a company that ceased to be a subsidiary part way through the year. There were no outstanding balances with this company at the reporting date’. These considerations apply equally to disclosure of any parent or ultimate controlling party.

Aggregation of transactions

It is clearly not expected that each transaction with each related party is disclosed separately in the financial statements, and nor would it be reasonable to be required to disclose total transactions for each counterparty: this would be unwieldy, and would not take enough account of the ways in which such information is commercially sensitive. Aggregation is therefore permitted, into the categories:

- •investors in the entity (those which have control, joint control or significant influence);

- •investees of the entity (subsidiaries, joint ventures or associates);

- •key management personnel;

- •entities which provide key management personnel services to the company; and

- •other related parties (this would include, among others, fellow subsidiaries in a group, close family of key management personnel, and pension schemes).

Along with this grouping into categories, ‘items of a similar nature’ may also be aggregated, so there might be a grouping of ‘sales of goods to subsidiaries and associates’ or ‘loans owed to investors with significant influence’. The exception to this permission to aggregate is in FRS 102:33.14, which requires separate disclosure where this is necessary for a full understanding of the effects of related party transactions on the financial statements.

| Example – Exception to aggregation

A company that guarantees the debts both of one of its fellow subsidiaries and of the adult stepdaughter of one of its directors would, in theory, be able to aggregate the disclosures of these items, as they are ‘items of a similar nature’ transacted with entities in the category ‘other related parties’. This aggregation, though, would obscure the uncommon nature of one of the transactions (the guarantee for the family members) and as such this seems to be a case for further disaggregation under FRS 102:33.14. |

Materiality

FRS 102:33 does not make any explicit reference to the concept of materiality. As such, it must be assumed that materiality is as relevant a concept as it is everywhere else in the standard, so related party relationships and transactions should be disclosed if ‘[their] omission or misstatement could influence the economic decisions of users made on the basis of the financial statements’ (FRS 102:2.6). Some of this phrasing is picked up in FRS 102:33.9, which requires the disclosure of transactions and the nature of the related party relationship so far as is ‘necessary for an understanding of the potential effect of the relationship on the financial statements’.

It seems best to err on the side of caution in making materiality judgements in such a sensitive area. It may be, in the board’s view, irrelevant that transactions took place with a company majority-owned by one of the directors, perhaps because the financial value is low, or because the board are confident that the transaction was on commercial terms and was unaffected by the position of the director. This is not, though, entirely the board’s judgement to make: users may quite reasonably be interested in such transactions even when they are of low value, and should where possible be enabled to make that judgement of interest for themselves. In borderline cases, therefore, where the monetary value of related party transactions is a little below the materiality threshold used for preparing the remainder of the financial statements, it may still be most appropriate to disclose the transactions anyway. There may well also be occasions where very low-value items should be disclosed, such as assets or services sold at artificially low prices to related parties, or loans provided at zero interest. In these cases, the absolute value is not a material number, but the absence of charge of a proper price may be a material fact (depending partly on the true value of the items or services which are being given away or undercharged for).

Practical presentation

Depending on the volume and diversity of an entity’s related parties and its transactions with them, the most efficient and readable way of providing the required disclosures will vary. For entities with a small number of simple arrangements, a few lines of narrative with figures may be sufficient; if the situation is more complex, though, a matrix presentation is easier to read at a glance, and can be augmented if necessary with additional narrative.

| Example – Disclosure

A company has drafted the following narrative note for its parent-only financial statements: During 20X1, the company made sales of £145,000 and purchases of £215,000 respectively to and from its fellow subsidiaries (20X0: £138,000 and £190,000). The related balances receivable and payable at the year end were £35,000 and £51,000 (20X0: £12,000 and £nil). It provided management services valued and charged at £200,000 (20X0: £200,000) to its subsidiary companies, relating to which £400,000 (20X0: £200,000) was outstanding at the year end. The company was also in receipt of loans for the first time this year from some members of its key management personnel. £150,000 was advanced during the year, of which the whole balance remained outstanding at the year-end; interest charges of £1,200 were accrued within the year and have been added to the outstanding loan balance. The company’s office is leased from its parent, at a rent of £120,000 per year (20X0: £120,000) all of which was paid during the year. This could, as an alternative, be summarised in a table:

|

||||||||||||||||||||||||||||||||||||||||

The only point to be careful with in this note is the implication in the comment about management charges being ‘valued and charged at £200,000’. FRS 102:33.13 forbids claims that transactions are made on an arm’s length basis ‘unless such terms can be substantiated’ and so it is important to avoid using language that suggests there is an objective value to a transaction if this is not really the case.

Since some of the transaction types required to be disclosed are also covered by other Sections of the standard (for instance, lease arrangements, directors’ remuneration, and financial instruments), additional information may be required. The simplest approach seems to be to include all of the information required by FRS 102:33 in one self-contained ‘related party transactions’ note, with cross references to where more details about certain transactions can be found. An alternative, though, is to include the FRS 102:33 disclosures in each relevant note (e.g. a section on loans from related parties within the financial instruments note) with an additional related parties note in place only to ‘mop up’ those which are not disclosed elsewhere. This may be preferred by some preparers, and arguably has the effect of being more informative to users by helping them to understand related party transactions in the context of the entity’s operations, rather than as if they were a distinct group, disclosed on their own at the very back of the financial statement.

All large and medium-sized parent companies must include details of all related undertakings in the notes to their financial statements. The detailed disclosure requirements are set out in SI 2008/410, Sch. 4, which is divided into three Parts:

Financial information about subsidiary undertakings

(1) There must be disclosed with respect to each subsidiary undertaking not included in consolidated accounts by the company—

(a)the aggregate amount of its capital and reserves as at the end of its relevant financial year, and

(b)its profit or loss for that year.

(2) That information need not be given if the company is exempt by virtue of section 400 or 401 of the 2006 Act from the requirement to prepare group accounts (parent company included in accounts of larger group).

(3) That information need not be given if the company’s investment in the subsidiary undertaking is included in the company’s accounts by way of the equity method of valuation.

(4) That information need not be given if—

(a)the subsidiary undertaking is not required by any provision of the 2006 Act to deliver a copy of its balance sheet for its relevant financial year and does not otherwise publish that balance sheet in the United Kingdom or elsewhere, and

(b)the company’s holding is less than 50% of the nominal value of the shares in the undertaking.

(5) Information otherwise required by this paragraph need not be given if it is not material.

(6) For the purposes of this paragraph the “relevant financial year” of a subsidiary undertaking is—

(a)if its financial year ends with that of the company, that year, and

(b)if not, its financial year ending last before the end of the company’s financial year.

Shares and debentures of company held by subsidiary undertakings

3.—(1) The number, description and amount of the shares in the company held by or on behalf of its subsidiary undertakings must be disclosed.

(2) Sub-paragraph (1) does not apply in relation to shares in the case of which the subsidiary undertaking is concerned as personal representative or, subject as follows, as trustee.

(3) The exception for shares in relation to which the subsidiary undertaking is concerned as trustee does not apply if the company, or any of its subsidiary undertakings, is beneficially interested under the trust, otherwise than by way of security only for the purposes of a transaction entered into by it in the ordinary course of a business which includes the lending of money.

(4) Part 5 of this Schedule has effect for the interpretation of the reference in sub-paragraph (3) to a beneficial interest under a trust.

Significant holdings in undertakings other than subsidiary undertakings

(1) The information required by paragraphs 5 and 6 must be given where at the end of the financial year the company has a significant holding in an undertaking which is not a subsidiary undertaking of the company, and which does not fall within paragraph 18 (joint ventures) or 19 (associated undertakings).

(2) A holding is significant for this purpose if—

(a)it amounts to 20% or more of the nominal value of any class of shares in the undertaking, or

(b)the amount of the holding (as stated or included in the company’s individual accounts) exceeds one-fifth of the amount (as so stated) of the company’s assets.

5.—(1) The name of the undertaking must be stated.

(2) There must be stated—

[F2(a)the address of the undertaking’s registered office (whether in or outside the United Kingdom),]

(b)if it is unincorporated, the address of its principal place of business.

(3) There must also be stated—

(a)the identity of each class of shares in the undertaking held by the company, and

(b)the proportion of the nominal value of the shares of that class represented by those shares.

Stable supply of monopiles to solve the bottleneck in the European offshore wind power industry and the contribution to green transformation :

On August 14, Sumitomo Corporation (Head Office: Chiyoda-ku, Tokyo; Representative Director, President and Chief Executive Officer: Shingo Ueno) reached an investment and business operation participation agreement with EEW Offshore Wind EU Holding (EEW), a Germany-based worldwide leading manufacturer of “Monopiles”, large diameter steel pipes used for the foundation of bottom-fixed offshore wind power generation. Completion is scheduled for the end of December 2024, subject to various legal and regulatory requirements

OPEN.SANCTIONS (OS):

Japanese traders including Marubeni Corp and Sumitomo Corp that stopped buying Iranian oil during western sanctions are looking to resume imports, potentially by year-end, industry sources said. Conservative Japanese firms have so far held off taking Iranian crude due to a lack of internationally acceptable insurance coverage, but are looking at ways of using cover provided by the Japanese government, the sources said. The traders seeking to restart purchases together imported around 50,000 barrels per day (bpd) of Iranian oil before sanctions were imposed and renewed purchases would give a boost to Tehran’s aim of increasing its exports to 4 million bpd…” (Reuters, “Some Japan trading houses eye resuming Iran oil imports-sources,” 10/19/2016). (http://www.reuters.com/article/iran-oil-japan-idUSL3N1CB1MP)

Sumitomo Corporation lists an office in Tehran. Its subsidiary, Sumitomo Electric, lists a past Major Power Transmission Line Installation Project in Iran. (http://www.sumitomocorp.co.jp/english/company/point/mneast/) (http://global-sei.com/gt/index.html)

Listed as an approved vendor in Iran by NIOEC, NPC, POGC, NIGC and IOOC. (https://www.vlist.ir/en/search/view/vlist:2/page:5/ipp:32)

—

Sumitomo Electrical Industries features on the official Iranian vendor website, “VList” – the ‘petroleum and energy vendor source search engine of I.R. Iran’ (https://www.vlist.ir/en/search/view/vlist:180/page:31/ipp:32)

Norges Bank Investment Management observation and exclusion of companies

Companies excluded from investment by Norway’s Government Pension Fund Global, or listed for observation.

This dataset lists companies which are excluded from investment by Norway’s Government Pension Fund Global, or placed under observation. Decisions are guided by a set of guidelines from Norway’s Ministry of Finance, with final decisions made by Norges Bank’s Executive Board.

From their Ethical Exclusions page:

Companies may be excluded or placed under observation if there is an unacceptable risk that the company contributes to or is responsible for:

- serious or systematic human rights violations

- serious violations of individual’s rights in situations of war or conflict

- the sale of weapons to states engaged in armed conflict that use the weapons in ways that constitute serious and systematic violations of the international rules on the conduct of hostilities

- the sale of weapons or military materiel to states that are subject to investment restrictions on government bonds

- severe environmental damage

- acts or omissions that on an aggregate company level lead to unacceptable greenhouse gas emissions

- gross corruption or other serious financial crime

- other particularly serious violations of fundamental ethical norms

-NORGES.BANK.website>> :Norges Bank decides on the exclusion of companies from the fund’s investment universe, or to place companies on an observation list. Exclusions as of 1 January 2015 are the decision of Norges Bank’s Executive Board. Exclusions previous to this date are decisions made by the Ministry of Finance. The decisions are based on recommendations from the Council on Ethics appointed by the Ministry of Finance. For the product-based coal criterion, decisions are based on recommendations from Norges Bank Investment Management. Exclusions are regulated by the Guidelines for the observation and exclusion of companies from the Government Pension Fund Global, adopted by the Ministry of Finance on 18 December 2014. The following alphabetical overview shows companies that are currently excluded or under observation. Latest update: 3 December 2024

18 December 2023

The Norges Bank Executive Board has decided to exclude Delek Group Ltd due to unacceptable risk of the company contributing to or being responsible for serious breaches of ethical norms, ref. the conduct-based criterion in the Guidelines for Observation and Exclusion from the Government Pension Fund Global § 4 h. The decision is based on a recommendation from the Council on Ethics of 30 May 2023, based on the company’s petroleum prospecting offshore West Sahara.

The Executive Board has also decided to place KDDI Corp and Sumitomo Corp under observation for a period of three years due to unacceptable risk that the companies are contributing to serious violations of the rights of individuals in situations of war or conflict, ref. the conduct-based criterion in the Guidelines for Observation and Exclusion from the Government Pension Fund Global § 4 b. The recommendation relates to the companies’ telecommunications business in Myanmar.

The decision is based on two recommendations from the Council on Ethics of 29 June 2023. The Council recommended exclusion of the companies. According to the Guidelines § 6(5), companies may be placed under observation if it is uncertain whether grounds for exclusion exist or what developments may occur forward in time, or when expedient for other reasons. Based on the recommendations, the Executive Board has emphasized steps the companies have taken, including conducting human rights due diligence, assessing the human rights situation in the country and dialogue with human rights experts. The observation period gives the Council on Ethics the opportunity to observe the companies’ further efforts to manage human rights risk and the development of the companies’ business in Myanmar.

The Executive Board has not conducted an independent assessment of all aspects of the above recommendations but is satisfied that criteria for the exclusion and observation have been fulfilled. Before deciding to exclude or place a company under observation, Norges Bank shall consider whether the use of other measures, including the exercise of ownership rights, may be better suited. The Executive Board concludes that it is not appropriate to use other measures in these cases.

Furthermore, the Executive Board has decided to end the special exercise of ownership in PetroChina Co Ltd. In February 2020, the Council on Ethics recommended that Norges Bank exclude PetroChina Co Ltd from the fund due to unacceptable risk that the company contributes to, or is responsible for, gross corruption, ref the conduct-based criterion in the Guidelines for Observation and Exclusion from the Government Pension Fund Global § 4(g). The Executive Board of Norges Bank decided that the matter should instead be taken up with the company through active ownership over a period of three years. The ownership period has now come to an end, and the Executive Board finds that the risk of future norm violations appears to be sufficiently reduced. The special exercise of ownership will therefore end, and going forward, Norges Bank Investment Management will continue to engage with the company as part of its regular ownership activities. See more information about the special ownership engagement below.

The Executive Board has also decided to extend the special exercise of ownership in Shell PLC and Eni SpA by two years. The Council on Ethics recommended in March 2013 to place the companies under observation due to unacceptable risk that the companies contribute to or are responsible for severe environmental damage, ref the conduct-based criterion in the Guidelines for Observation and Exclusion from the Government Pension Fund Global § 4(e). The recommendations were based on the companies’ activities in the Niger Delta. The exercise of ownership has now lasted for ten years. Norges Bank Investment Management has during this time met the companies regularly, including through in-person meetings, video conferences and written correspondence. The Executive Board has now assessed the case and progress towards the ownership objectives. Overall, the Executive Board finds that there is still a forward-looking risk of norm violation. At the same time, the exercise of ownership has been constructive and the Board notes that the companies have publicly expressed an ambition to divest the relevant assets in the Niger Delta.

The Council on Ethics’ recommendations: Delek Group Ltd KDDI Corp Sumitomo Corp

Press contact: Line Aaltvedt. Head of Communications. Tel: +47 948 54 656 Email: press@nbim.no

| Country | Norway | [sources] |

|---|---|---|

| Authority | Norges Bank Investment Management | [sources] |

| Description | Observation | [sources] |

| End date | not available | [sources] |

| Listing date | [sources] | |

| Program | Conduct-based | [sources] |

| Reason | Serious violations of individuals’ rights in situations of war or conflict | [sources] |

| Start date | not available | [sources] |

| Source link | www.nbim.no · www.nbim.no | [sources] |

| Data sources | Norges Bank Investment Management observation and exclusion of companies | |